An Enduring Mission: CEF History

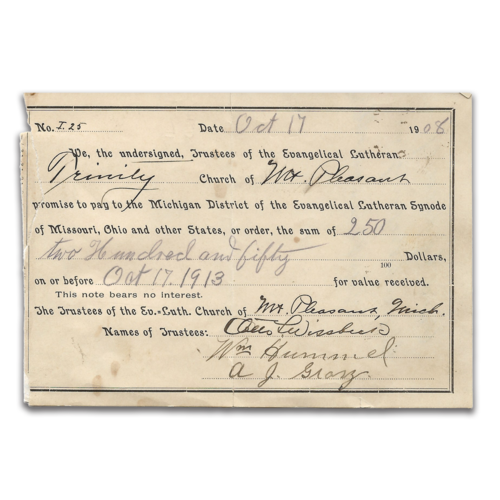

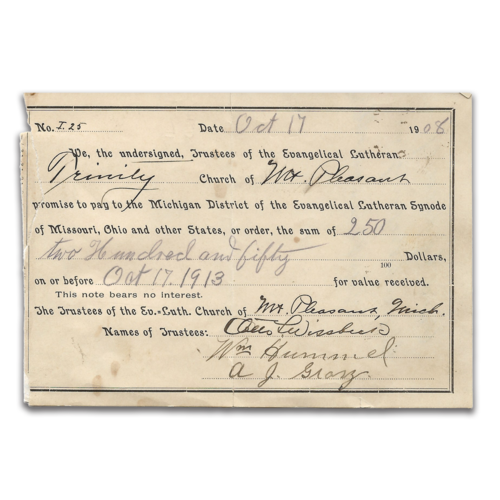

1901

Lutherans Establish Church Extension Fund to Build Churches

In response to the desire to start new churches in Michigan, a group of faithful Lutherans create what is now known as Church Extension Fund. Eager investors contribute funds that are then loaned out to help build some of the first Lutheran churches in Michigan.

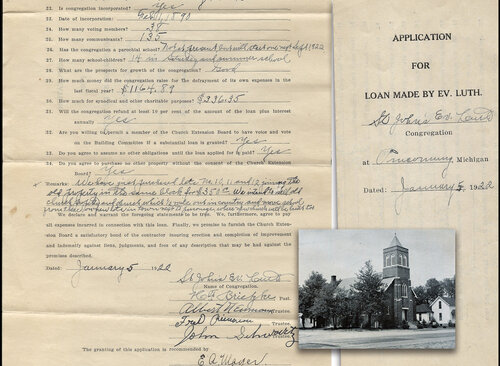

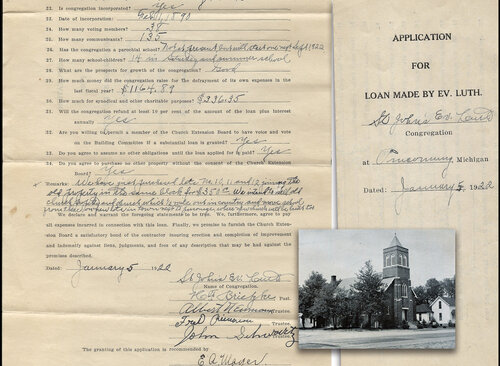

1922

Lutheran Churches Rely on CEF for Growth

More and more Lutheran churches use CEF to help build or upgrade facilities. Pictured is St. John - Pinconning that used a CEF loan to build both a church and parsonage (circa 1922). This building served St. John until 1982 when a new church is constructed, once again with the help of a CEF loan.

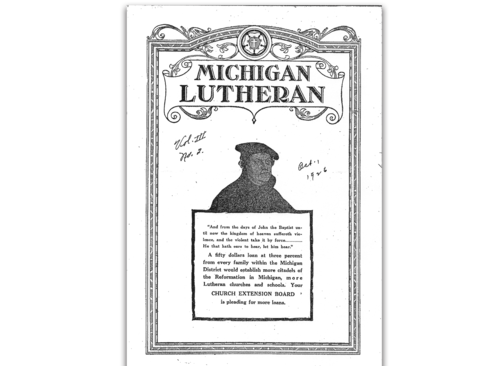

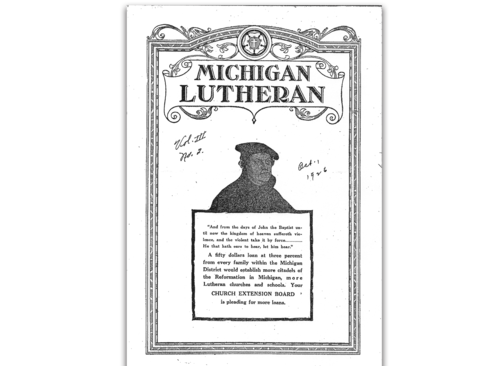

1926

Growing Loan Demand Spurs Call for More CEF Investments

As loan demand rises, so does the need for more investments from Lutherans throughout Michigan. This ad in the Michigan Lutheran from October 1926 pleads with parishioners to invest with CEF. The ad also appears in German as many Lutheran churches hold worship services in German.

1940

Post Great Depression Growth

Having weathered the Great Depression, CEF experiences steady growth in both loans and investments. The Fund’s total assets are approximately $750,000 in 1940, (equivalent to $17 Million today), a healthy number following such a major economic downturn.

1957

CEF Expands, Hires First Director & Moves to Detroit Office

As CEF enjoys banner growth, something more than volunteers are needed to manage the fund. The Board hires Marv Heinitz to oversee operations. CEF operated out of a choir robing room at Epiphany Lutheran - Detroit, until moving to its first brick-and-mortar office along 7 Mile Road in Detroit.

1961

CEF Launches Savings Stamps Program to Teach Young Investors

CEF begins selling its first savings stamps to the school children at St. Paul - Farmington. The stamp program soon expands to the entire District as it proves to be a great way to teach stewardship to a younger generation of investors. Throughout the years, the Savings Stamps program uses themes like Tracky the Stamp, Heroes of the Faith, and Noah’s Weird Animals.

1966

CEF Moves to Ann Arbor

Land is procured by the Michigan District to build Concordia Junior College in Ann Arbor. CEF moves to a new office building on the land which also houses all District operations. The move to Ann Arbor fosters a great working relationship between the Michigan District and CEF that lasts to this day.

1968

CEF Loan & Student Campaign Fund for Dorms at Concordia

As Concordia grows, so does their need for dormitory space. A major student-led capital campaign, combined with a CEF loan, provides the funds for new dorms.

1983

CEF Reaches $50M, Launches Grant Program to Support Ministries

As the fund nears $50 Million in total assets, CEF celebrates its success by serving ministries in a new way – through the CEF Grant program. Since its inception, more than $20 Million has been granted to support mission and ministry throughout the Michigan District. Key grants help congregations enhance areas like technology, aesthetics and security.

1984

CEF Fall Conference Honors & Inspires Dedicated Volunteers

CEF maintains a strong volunteer base across the District. As a way to inspire and thank these CEF Reps for their hard work, the CEF Fall Conference (f/k/a CEFARI) is started. This annual leadership conference continues today, serving both CEF Reps and District leadership with great speakers, great food and great fellowship.

1994

Marv Heinitz Retires, Ron Steinke Named CEO as CEF Nears $100M

After 37 successful years leading CEF, Marv Heinitz retires. The Board hires fellow member Ron Steinke as its new CEO. Steinke inherits a fund in good financial shape with total assets near $100 Million.

1997

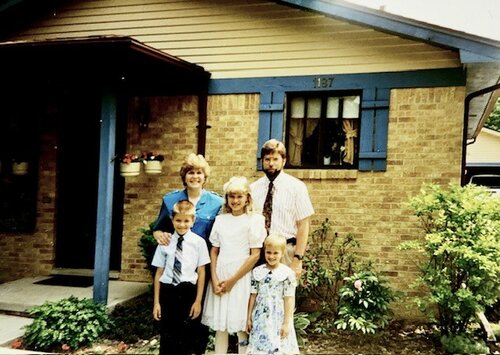

CEF Launches Church Worker Housing Loan Program, Issuing Nearly 1000 Housing Loans

As a new way to help attract and retain church workers in the Michigan District, CEF unveils its Church Worker Housing Loan Program. Hard working employees at churches, schools and other ministries obtain down payment assistance and mortgage loans in an easy and seamless process. More than 1000 housing loans have been issued by CEF since then.

2003

CEF Hits $200M, Expands Services with Grants & Giving Programs

Significant capital projects throughout the Michigan District during the 1990s allows CEF to quickly reach a milestone of $200 Million in total assets. In addition to grants, CEF starts offering congregational services. Examples include providing a Gift Planning Counselor to help Lutherans plan and direct their legacy gifts, and offering Excel In Giving which provides an electronic giving platform for worshipers to support their church.

2016

Ron Steinke Retires, Jim Saalfeld Becomes CEO as CEF Hits $50M in Net Worth

After 22 years of leadership, Ron Steinke retires. CEF once again looks to its experienced Board and hires Jim Saalfeld, the former Board Chairman, to assume the role of CEO. As the torch is passed, CEF crosses another significant financial milestone, reaching a record $50 Million in net worth

2018

CEF Surpasses $500M in Total Loans with Shepherd of the Lakes Expansion

A loan to assist Shepherd of the Lakes - Brighton expand their school marks a milestone for CEF as it records more than $500 Million in total loans issued since its founding. These loans have helped congregations, schools and other ministries Build the Kingdom in Michigan.

2021

CEF’s Century-Long Mission Endures

The mission of CEF remains unchanged since its founding over a century ago. Despite pandemics, depressions and world wars, CEF continues to make loans, investments, grants and services available to Lutheran ministries in the Michigan District. Even through 120 years of service, new products, brand, and innovative solutions continue to emerge to better serve the congregations, schools and other ministries of the Michigan District so that they can continue spreading the Good News of Jesus

2023

CEF marks milestone - over $600 M loaned to Lutheran ministries to help build the Kingdom

With it's continued efforts to support Lutheran ministries in Michigan, CEF marks a milestone of providing over $600 Million in loans to ministries. These loans are used to build new sanctuaries and schools, renovate current spaces, and to make renovations. CEF is blessed to work with Michigan District ministries!